Since retirement accounts are very common assets amongst seniors, it’s vital to understand how to deal with these accounts in crisis Medicaid planning. If your client or their spouse owns an IRA that is considered countable in their state, they must eliminate the account before qualifying for Medicaid. However, liquidating an IRA often results in hefty tax consequences. Fortunately, your client can transfer their IRA funds into a Medicaid Compliant Annuity (MCA) as part of their spend-down plan for Medicaid eligibility.

Read More: Understanding Medicaid’s Lookback Period and Its Impact on Asset Transfers

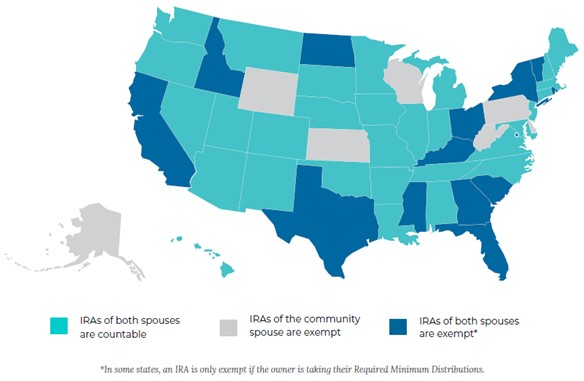

Are IRAs Countable or Exempt in Your State?

Read More: Is Your Client’s IRA Countable or Exempt for Medicaid?

Consequences of Liquidating an IRA

If your client liquidates their IRA, it’s important to be aware that all of the funds count as taxable income in the year of receipt, which means the account owner may be subject to a higher income tax rate. Plus, if a couple’s income exceeds certain thresholds, a portion of their Social Security benefits may become taxable, and their Medicare Part B and Part D premiums may increase.

That’s where a Medicaid Compliant Annuity comes in.

Transferring IRA Funds to an MCA

If your client resides in a state where their IRA is countable for Medicaid purposes, they can fund the account into a tax-qualified MCA. This allows them to preserve the funds and avoid the immediate tax consequences of liquidation. The transfer of the funds is not a taxable event, and the funds are taxed in the year each payment is made over the term of the annuity. For IRA-MCAs, a longer term is ideal in order to spread out the tax consequences and increase the economic benefit for the client.

Read More: What Is a Medicaid Compliant Annuity?

To transfer an IRA to an MCA, your client has two options: Trustee-to-Trustee Transfer or 60-Day Rollover.

A Trustee-to-Trustee Transfer takes place directly between plan administrators. The IRA owner completes authorization paperwork for the transfer along with the MCA application, and the MCA carrier obtains the funds from the IRA custodian company. This option may take 4-6 weeks.

With a 60-Day Rollover, the IRA owner initiates complete account liquidation without withholding taxes. They will receive the liquidation check (typically within 5-7 business days), and they have 60 days to reinvest the funds into a tax-qualified MCA in order to avoid immediate taxation. This option may take less than 4 weeks, but individuals are limited to one rollover per 365-day period.

Read More: What Is the “Name on the Check Rule” MCA Strategy?

Eliminating Countable IRAs for Medicaid

When it comes to crisis Medicaid planning, retirement accounts like IRAs can present unique challenges—but also strategic opportunities. For clients in states where IRAs are countable, converting those funds into a Medicaid Compliant Annuity offers a powerful solution to preserve assets, minimize tax exposure, and expedite Medicaid eligibility.

As an agent, understanding the nuances of how IRAs are treated under Medicaid rules and how to navigate rollover or transfer options effectively is key to providing your clients with the best possible outcome. Collaborating with a knowledgeable team and incorporating tools like the MCA into your planning strategies can make a significant difference in your client’s financial future.

Have questions about using an MCA in your client’s Medicaid plan? Let’s talk. Book a call with us and we’ll help you implement these strategies with confidence.